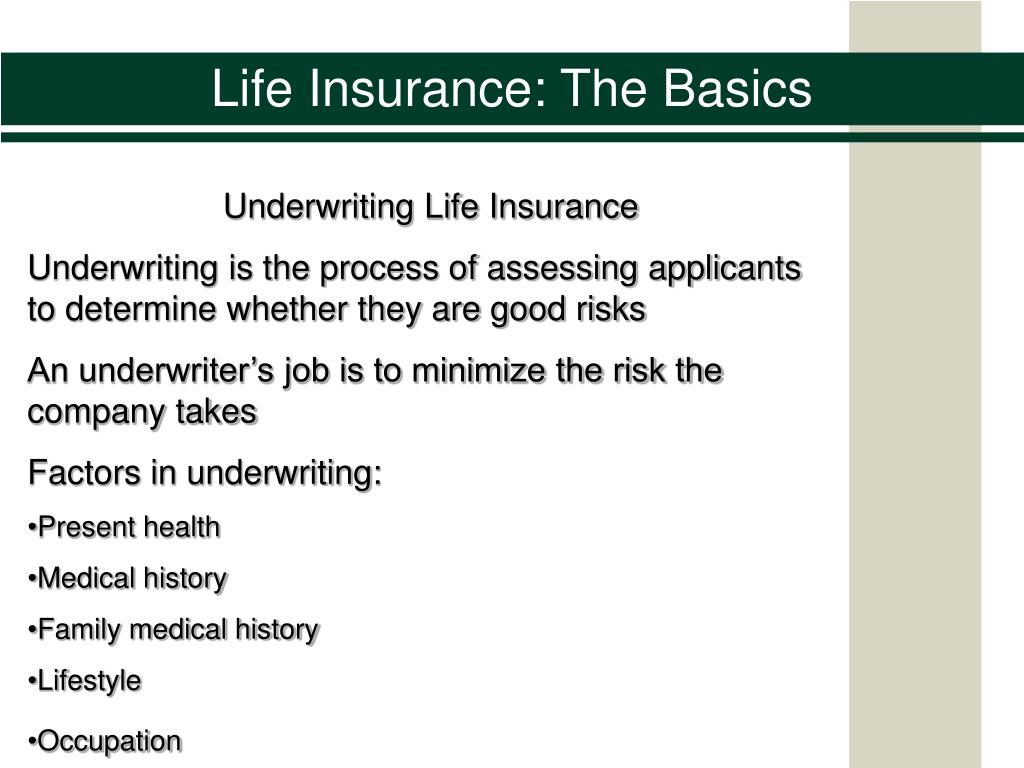

Let’s walk through the different kinds of insurance and see how underwriting fits in. Many of the individual factors that determine risk change from one kind of insurance to another. Underwriters commonly follow strict guidelines on who the provider wants to insure, but there are some judgement calls that underwriters must make themselves, so underwriters need to know the risks associated with their business inside and out. Nowadays most underwriters rely on special software that uses large databases and statistical analysis to determine risk. To figure out how much risk an individual represents, underwriters draw on a range of tools. In a nutshell, the job of the insurance underwriter is to make sure the insurance company is making good bets. When a provider agrees to insure new policies, the insurance company is betting that the premiums policyholders pay them will outweigh the cost of the claims the company pays out. In this article, we’ll walk through the central role underwriters play in the insurance industry, as well as what factors underwriters consider when assigning risk to policies for different types of insurance. That risk determines the cost you pay for your insurance. Insurance underwriters look at all the factors that affect the level of risk in an insurance policy.Īfter considering these factors, an underwriter will assign the level of risk that the policy represents to the provider. Ever wonder who decides how much your insurance policy costs? That’s the job of underwriters.

0 kommentar(er)

0 kommentar(er)